SOLUTIONS IN A FLASH – Retirement Plan Correction Solution:

What is UBTI Anyway? George Invests 401(k) Assets in a Partnership Operating a Business

By: Jason W. Douthit, Esq.

George and Jerry each own small businesses and regularly meet at Monk’s Café to mull over mostly mundane material. One day while eating lunch and discussing how much money they will need to retire, Jerry humbly brags between sips of black coffee, “Recently, I have realized great returns by making unorthodox investments with my 401(k) plan account. For example, I made a loan to my neighbor, Newman. He was laid off by the post office and used the loan to start a business that throws out your junk mail, so you don’t have to. People hate junk mail and pay good money to not have to deal with it! He is making a killing for both of us!” George is anxious about the small nest egg he has saved for retirement and mildly jealous of Jerry’s investment success and prospects for a comfortable retirement.

Several weeks later, George overhears his friend, Kramer, talking about how his business, Vandelay Industries LLP (“Vandelay”), is looking to infuse some much-needed capital into the partnership to buy new machines for its latex factory. Thinking about Jerry’s recent success, George offers to lend money from his account in the Costanza & Son 401(k) Plan (the “Plan”) to Vandelay. Kramer hates debt and declines George’s offer, but invites George to use his Plan account to invest in Vandelay. George accepts the offer.

Roughly a year later, the Vandelay investment has tremendous returns. George celebrates his success at Monk’s Café by ordering two extra-large slices of key lime pie for Jerry and himself and tells the waitress (and anyone within earshot) that he is going to retire early to a beachfront condo in Florida. Before he can swallow the first bite of pie, George receives a call on his cell phone from his accountant. Jerry overhears the accountant say something ominous about “taxes due on the Vandelay partnership.” Confused and angry, George immediately leaves Monk’s without paying the tab. Unable to hail a cab, George walks several blocks in the summer heat to his accountant’s office. Sweating profusely and out of breath, George throws his hands in the air and demands to know what this is all about. The accountant explains that 401(k) plans would have an unfair advantage over taxable businesses if they were permitted to operate businesses but not pay taxes on the profits. To avoid putting regular (for profit) businesses at a competitive disadvantage, the IRS taxes profits realized by a 401(k) plan due to unrelated business taxable income (or “UBTI”).

What is UBTI?

UBTI is income received by a tax-exempt entity (such as a 401(k) plan) from a trade or business, regularly carried on by the tax-exempt entity, that is not substantially related to the charitable, educational, or other purpose that forms the basis for the entity’s tax-exemption. Some tax-exempt entities can regularly carry on a business without triggering UBTI so long as the business is substantially related to the entity’s tax-exempt purpose (for example, think of a charity that operates a thrift store that provides employment opportunities for disabled persons). The purpose of a 401(k) plan, on the other hand, is to provide tax-deferred investment income for retirement and has no charitable or educational purpose. 401(k) plans are merely intended to be savings vehicles. Therefore, a 401(k) plan will trigger UBTI if the plan regularly carries on any business or invests in a pass-through tax entity that regularly carries on any business.

Typical 401(k) plan investments are usually passive in nature, and do not constitute a business regularly carried on by the 401(k) plan. The types of returns that avoid the UBTI label because they are not deemed to be carrying on a business include: stock dividends, interest income, payments from annuities, mutual fund distributions, rent from real property, royalties, and gains on the sale of investments (except for gains on the sale of stock or inventory). So, for example, a 401(k) plan may invest in shares of a C corporation and receive dividends from the C corporation without incurring UBTI. As a side note, returns to a 401(k) plan from an investment obtained with money the plan borrows from another source (for example, stocks purchased with a margin account at a brokerage firm) constitute unrelated debt financed income (or “UDFI”) which is a form of UBTI and taxed as such. (But this is beyond the scope of this article.)

On the other hand, when a 401(k) plan invests in a pass-through tax entity, such as a partnership or S-corporation, the income received from the entity is UBTI insofar as it is attributed to an active trade or business carried on by the entity. A 401(k) plan must look through a partnership investment to the underlying operations or investments of the partnership to determine whether there is any UBTI. This is true even if a 401(k) plan is just an investor (a “silent partner,” if you will), uninvolved in the management or operation of the business. If, instead of being a partnership, Vandelay was a C corporation (not a pass through entity) operating a latex factory, then stock dividends paid by Vandelay to the Plan would not have been UBTI, even though Vandelay operates a business.

UBTI Ramifications for the 401(k) Plan

Unfortunately for George, Vandelay is a partnership that owns and operates a latex factory. The regular ongoing operation of the factory constitutes a business that triggers UBTI. Therefore, all Vandelay partnership income (less expenses) related to the latex factory and allocable to the Plan’s investment in Vandelay constitutes UBTI.

UBTI Taxes

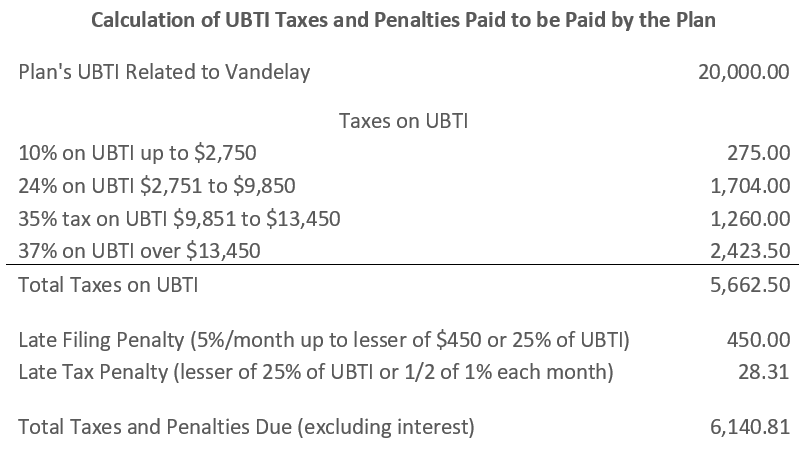

George’s accountant presents George with Form 990-T, the tax form that must be filed each year by 401(k) plans with more than $1,000 in UBTI. The accountant explains that the UBTI tax rates are the same rates that apply to trusts, which start at 10% on UBTI up to $2,750 and peak at 37% on UBTI that exceeds $14,450. The Plan has UBTI of $20,000 from the Vandelay investment, and therefore owes $5,662.50 in taxes (see the table below).

UBTI Late Penalties

George’s accountant explains that the Form 990-T is already five months late, as it is now August and was due by April 15, which is the deadline for 401(k) plans with calendar plan years. Because the 990-T will be filed late and the taxes paid late, interest and penalties will apply. The penalty for filing late is 5% of the unpaid tax each month (or part of a month) that the filing is late up to the lesser of 25% of the unpaid tax or $450 (as of 2022; this amount is indexed to inflation). For the late tax payments, an additional penalty of ½ of 1% of the unpaid tax for each month or part of a month that the tax remains unpaid up to a maximum of 25% of the unpaid tax.

The accountant sarcastically tells George not to worry though because the interest and penalties are not due when the Form 990-T is finally filed and taxes paid on the unrelated business income. Rather, the IRS will send a bill to Costanza & Son, Inc. (the Plan sponsor and administrator) for payment by the Plan.

The unexpected taxes have curtailed George’s expectations as to the amount of money he will have saved at retirement. Being an overly pessimistic fellow, instead of tanning on the beach in front of his Florida condo, George now envisions himself moving back in with his parents at retirement and being scolded regularly by his father for failing to understand the UBTI rules before investing in Vandelay.

Conclusion

All other things (such as risk and reward profiles for an investment) being equal, it is better to avoid 401(k) plan investments that may result in unrelated business income. Most plan administrators will seek to avoid such investments, but in some cases, the projected returns on investment could make the taxes palatable. The key is to understand in advance whether an investment may result in UBTI and to be prepared to file Form 990-T and timely pay the respective taxes.

UBTI issues may be very complex, and partnership investments by a retirement plan, in general, need to be evaluated carefully to determine if they will generate UBTI. Checking out the type of income that will be generated by a partnership in advance can allow you to invest wisely, knowing any possible tax ramifications and their effect on your return. This is particularly true if the partnership or business is involved in real estate; the rules for real estate investments in relation to UBTI are particularly labyrinthine.

Please contact us if you have questions about whether a potential investment may result in taxes on unrelated business income. Remember: we are your ERISA solution!

- Posted by Ferenczy Benefits Law Center

- On September 28, 2023