FLASHPOINT: Final Catch-up Regulations… Finally

By: Ilene H. Ferenczy, Esq.

As discussed in our last FlashPoint, on September 16, 2025, the Treasury Department issued final regulations in relation to the SECURE 2.0 catch-up contribution provisions (“Final Regs”). The Final Regs address both the higher catch-up limit for individuals aged 60 to 63 (“60-63 Limit”), as well as the much-discussed required Roth catch-up contributions for highly paid individuals (“Roth Catch-up”). As discussed in the earlier FlashPoint, the 60-63 Limit is in place for 2025, and the Roth Catch-up rules are effective as of January 1, 2026. The Final Regs are effective as of tax years beginning after December 31, 2026, which means that plans and taxpayers need to exercise “good faith” compliance in the meantime. The best course of action: follow the Final Regs as much as possible.

FBLC sent comments on the proposed regulations to the IRS in the hope that some of the things that concerned us would be addressed in the Final Regs. Some of our questions were answered; others, not so much. In this FlashPoint, we will point out issues that we think are still outstanding.

We outlined the issues relating to these catch-up rules in our FlashPoint on the proposed regulations. For the sake of addressing the Final Regs with some level of brevity (okay, with as much brevity as is humanly possible), we will not repeat those rules here. What we will discuss is what issues have been resolved and what we recommend for those that are still open questions.

Final Rules Regarding the 60-63 Limit

This provision is much more straightforward and much less controversial than the Roth Catch-up provision. Think of this part as a mental warm-up for the heavy lift coming.

We had two basic questions from the proposed regulations:

- Do we need to amend plans to provide for the 60-63 Limit, or is the plan presumed to have the limits unless it specifically provides that it does not?

- Can the plan provide for higher limits, but for only some of the 60-63 group (such as, only those between 62 and 63), and can the limits be in a dollar amount that is less than the actual 60-63 Limit?

In regard to the first question, the answer is that the plan document must reflect the 60-63 Limit if it is being made available. The preamble to the Final Regs (the “Preamble”) states, “The Treasury Department and the IRS expect that a plan’s terms will be made clear as to whether or not a reference to the catch-up contribution limit under section 414(v) in the plan document includes the optional higher limit for participants attaining age 60, 61, 62, or 63.” The Preamble then points out the amendment deadline for SECURE 2.0 under Notice 2024-02. Therefore, you should be sure that the SECURE 2.0 amendment contains this provision if the higher limit is to be used.

> The deadline for most nongovernmental plans to adopt the amendment is December 31, 2026. It can be retroactively effective. Therefore, you can use the new provision in 2025, even if the plan is not formally amended until sometime in 2026.

The second question involves some complexity, because of the Universal Availability requirement of Code section 414(v)(4). Under that section, all eligible participants in the plan or any plan of an affiliate must be able to elect the same amount of elective deferrals. How is this rule met if some employees can defer only the normal deferral limit, while others can defer 150% of the limit? The Final Regs provide that the Universal Availability rule is met if “each catch-up eligible participant who participates under any applicable employer plan maintained by the employer is provided with an effective opportunity to make the maximum amount of catch-up contributions permitted for that participant under section 414(v).” Therefore, providing a higher-than-normal limit, but one that is less than the 60-63 Limit, or providing the 60-63 Limit for some, but not all, of the participants in the 60-63 age range will violate the Universal Availability rule and is not permitted.

> If you don’t want the 60-63 increase, exclude it entirely for everyone; do not try to dial it down selectively.

There is an exception to this rule that permits the plan to have different catch-up rules for collectively bargained or nonresident alien employees.

Final Rules Regarding Roth Catch-Up

The rules regarding the Roth Catch-up are, of course, more complex, with more questions to be asked and answered. As with our prior FlashPoints, we will refer to the employees to whom the Roth Catch-up rules apply (i.e., people with prior year FICA compensation in excess of an annual limit, currently $145,000) as “Highly Paid Individuals” or “HPIs.” This is important, because not all HPIs are HCEs. The Final Regs clarify that the compensation to use for purposes of determining if someone is an HPI is that which is shown on the prior year’s Form W-2, Box 3.

> Some practitioners asked to use Box 5, Medicare wages. Typically, this is the same as Box 3, but they can differ, particularly for state and local government employers. The Preamble stated that Box 3 must be used, but added that, until the Final Regs apply (in 2027), it is acceptable to use Box 5.

Universal Availability and Nondiscrimination

If a plan does not permit Roth contributions, HPIs will not be able to make catch-up contributions. Does this violate either Universal Availability or nondiscrimination rules? Closely tied to this question is the fact that some of the HPIs may be nonhighly compensated employees (“NHCEs”). Does the plan need to demonstrate that the available catch-up contributions meet the “benefits, rights, and features” requirements of Code section 401(a)(4)?

The Final Regs again take the position that everyone has to be able to make their maximum catch-up contribution for both Universal Availability and nondiscrimination rules to be met. Therefore, if the plan does not have Roth contributions, the HPIs’ maximum catch-up is $0, and that is fine for Universal Availability.

The Final Regs reflect Treasury’s concern about disparity between HPIs and HCEs who were not HPIs. They note that this would happen mostly in situations where the HCE is a partner in a partnership, and does not receive FICA wages. If the plan does not allow Roth deferrals (and therefore HPIs cannot make catch-up contributions), the “fix” suggested (but not necessarily mandated) by the Final Regs is that the plan prohibit catch-up contributions for HCEs who would be HPIs if their net earnings from self-employment constituted FICA wages. Therefore, if the plan permits Roth deferrals (and, therefore, HPIs can make catch-up contributions), there is still no need to subject self-employed HCEs to the Roth Catch-up requirement.

Deemed Roth Election

The Final Regs retain the ability of the plan to have a deemed election under which all HPIs are treated as if they elected for any catch-up contribution to be treated as Roth, thus allowing the plan to automatically convert pre-tax amounts that become catch-up contributions to Roth. The Final Regs also retain the requirement that this deemed election is available only if an affected HPI is given the “effective opportunity” to elect otherwise – that is, to have the amount distributed as excess deferrals rather than reclassified as Roth.

We asked the Treasury in our comment letter to give us guidance as to what constituted an “effective opportunity” and when it had to be offered. The Treasury noted the question in the Preamble, stated that this is to be judged on a facts and circumstances basis, and declined to give further guidance. While the notice of the ability to make this alternate election potentially could be provided in the summary plan description, the deferral election, or at the time that the participant’s deferrals exceed the applicable limit, we believe (but, of course, cannot guarantee) that including this information in the annual notices provided to all participants at the beginning of the year will likely meet the facts and circumstances test. Making the information as conspicuous as possible on that notice would be a good idea, and you should include the means by which this alternate election may be made.

> There are two problems with waiting until a participant’s deferrals exceed a limit: (1) In the case of the ADP limit, the plan won’t know until the end of the year; and (2) If you wait until the participant exceeds the regular 402(g) limit, it will be too late to change the election for deferrals already made. Giving the explanation/notice to HPIs before the year and allowing them to opt out makes the most sense.

Correction of Excess Deferrals or Excess Contributions Made on a Pre-Tax Basis

The proposed regulations outlined strict deadlines for correction of situations where deferrals went into the plan as pre-tax, but needed to be Roth due to the catch-up rules (referred to in the Final Regs as “Section 414(v)(7) Failures”). These rules were somewhat relaxed in the Final Regs.

Both the proposed regulations and the Final Regs provide two ways to fix a Section 414(v)(7) Failure:

- Form W-2 Method. If discovered before the Form W-2 is issued, the plan may convert the pre-tax amount (and applicable earnings) to Roth (i.e., move it to the Roth account in the plan) and report the excess amount (not including earnings) as Roth on Form W-2.

- In-Plan Roth Rollover Method. Alternatively, the plan may move the excess (and earnings) to the Roth account and report the excess and earnings as taxable income on Form 1099-R in the year of the rollover. The Preamble clarifies that a plan can use this correction method even if it does not otherwise allow In-Plan Roth Rollovers, and states that doing so will not expand the In-Plan Roth Rollover availability to others.

Remember that a plan may permit any Roth contributions made during the year to be counted towards satisfying the Roth Catch-up requirement. For example, if a participant makes Roth contributions of $5,000 during the year, switches to pre-tax, and then hits a statutory or plan deferral maximum, those $5,000 can be considered, to the extent necessary, as the catch-up contributions. This would leave the participant free to make additional pre-tax contributions to the extent that the total catch-up requirement was less than the $5,000 amount. These rules remain as an option in the Final Regs. It may be a good idea for HPIs in plans with frequent ADP testing failures to make some contributions, perhaps up to the catch-up limit, as Roth, to avoid any reclassification during or after the year. The Final Rules also permit plans to decline to treat earlier Roth contributions as the catch-up contributions, which may make administration easier.

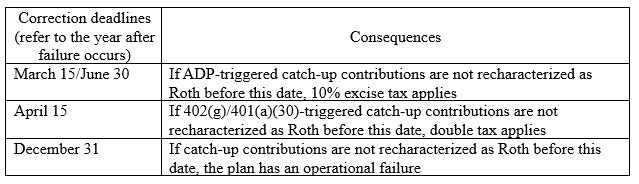

The Final Regs ease the timing rules for correction to provide that failures to properly classify excess deferrals or contributions as Roth may be corrected anytime before the end of the plan year following the plan year in which the excess arose (“Correction Deadline”). This later correction will preserve the qualification of the plan. However, the Final Regs also acknowledge that there may be additional tax ramifications if earlier deadlines are not met, depending on the Code sections that are being violated. These ramifications are described below.

Excess Deferrals – Amounts over the Section 402(g) Annual Limit

The rules for excess deferrals provide that, if they are not corrected by April 15 of the following year, the participant is taxed on the excess in the year they are contributed, as well as when the deferrals are ultimately distributed. The Final Regs provide that, if one of the above corrections is not completed by April 15, the double taxation will apply, despite the converted Roth nature of the deferred amounts. To retain the plan’s qualification, the correction must nonetheless happen by the Correction Deadline.

Excess Contributions – Amounts over the ADP Limit

Under Code section 4979, if HCE deferrals in excess of the amount allowed under the ADP testing are not repaired by March 15 (June 30 for applicable EACAs), there is a 10% excise tax to be paid by the employer on the excess. The Final Regs provide that, if the ADP failure for an HPI is not fully corrected by March 15 (or June 30, as applicable) under one of the above methods, the excise tax will be payable by the employer. Again, later correction by the Correction Deadline is required to retain the plan’s qualification.

Excess Amounts Due to Exceeding the Plan Limit

These amounts may be corrected by the Correction Deadline without further ramifications.

The following table summarizes the correction deadlines and consequences for a calendar year plan:

De Minimis Failures Need No Correction

If the excess amount that would normally need to be Roth is $250 or less, it can remain pre-tax, and no correction is needed.

Choice of Correction Method

The proposed regulations required that a correction method used in relation to a given violation (such as excess deferrals under Code section 402(g)) had to be the same for all participants with that violation. Comments to the proposed regulations (including ours) objected to this, because a plan will not necessarily know about all 414(v)(7) Failures (or even all Failures of a given variety) at the same time. The Final Regs relaxed this requirement, providing only that the same correction method must be used for “similarly situated participants.” That phrase is not defined. For example, people for whom failures are discovered before the Form W-2 is issued can constitute “similarly situated participants,” while those whose failure is discovered later are not part of that group.

Practices and Procedures

The requirement in the proposed regulations that employers must have practices and procedures (“P&P”) in place that specifically address Roth Catch-up issues in order to be eligible for self-correction is retained in the Final Regs. We have updated our templates for this purpose, which are available for purchase. If you are interested, please email us at FerenczyFlash@Ferenczylaw.com.

Other Questions Addressed in Final Regs

Who’s the Employer?

The Final Regs retain the rule that the “employer” for purposes of determining whether the FICA wages exceed the $145,000 (adjusted with COLAs) limit is the employee’s common law employer only. This means that a participant’s HPI status is judged on a company-by-company basis, and the Roth rules apply to deferrals from each company based on the participant’s HPI status for that company. (See our prior FlashPoint for examples.) This is true also in MEPs, where each participating employer is treated separately.

The Final Regs allow the company to aggregate the FICA wages from certain employers (and jointly determine whether someone is an HPI in relation to all aggregated companies). The companies that can be so aggregated are:

- All corporations that use a common paymaster under Code § 3121(s). Aggregation under this rule is optional.

- All affiliated (i.e., controlled group or affiliated service group) companies, regardless of paymaster. Aggregation under this rule is optional.

- Disregarded entities where the owner is treated as the employer and the wages include amounts paid by the disregarded entity and by its owner. Aggregation under this rule is mandatory.

In the calendar year of an asset purchase, and only if the FICA predecessor employer rule applies [Treas. Reg. § 31.3121(a)(1)-1(b)], a successor’s plan may elect to count the predecessor’s wages for HPI purposes. If a single Form W-2 was issued by the successor, all calendar-year wages (predecessor and successor) may be counted. If they issue separate Forms W-2, then the successor-countable wages for HPI purposes are capped at the Social Security taxable wage base minus the wages paid by the predecessor.

403(b) Plans

The Final Regs clarify that the requirement that catch-up contributions be Roth applies to employees of “qualified organizations” (i.e., those able to take advantage of the special catch-up contribution under Code section 402(g)(7)(B)) by increasing the amount permitted to be made as Roth by the 403(b)(7) amount. In other words, the special 403(b) catch-up contribution may be made on a pre-tax basis.

Puerto Rican Plans

The Puerto Rican Tax Code (PRT Code) does not permit Roth contributions. The Final Regs waive the Roth Catch-up requirement for participants subject to the PRT Code until such time as that Code is amended to permit Roth contributions. So, there is no need to worry about the Universal Availability rule or nondiscrimination in relation to those employees at this time.

* * * * *

We know that you may still have questions about these complex provisions. Check out our free ERISApedia webcast, starring Alison, Ilene, and Derrin on October 23, 2025, at 2:00 p.m. You can register here.

And, of course, you can always contact us with further questions. After all, we are your ERISA solution!

* * * * *

Other News

Welcome to our newest attorneys, Isaac Thuesen, Logan Fuzetti, and Dan McNamara!

Welcome to our new Project Manager, Julie McDougall!

Ferenczy Benefits Law Center filed its comments to the Department of Labor’s RFI on PEPs on September 29, 2025. If you would like to read the comments, you can find them here.

Both Ilene and Alison will be speaking at the ASPPA Annual Conference in San Diego on October 24-26, 2025. If you are there, be sure to come say hi to us and Carolyn Cumbee, who will also be attending!

- Posted by Ferenczy Benefits Law Center

- On October 16, 2025