SOLUTIONS IN A FLASH – RETIREMENT PLAN CORRECTION SOLUTION:

Money, It’s a Gas: How to Choose the Correct Definition of Compensation for Your Plan

By: Adrienne I. Moore, Esq.

Richard and David have opened a company, Shine On, Inc. They want to sponsor a retirement plan and reach out to Syd, a third party administrator, for assistance. When the three meet to discuss plan design, Syd starts to explain the various options for defining compensation. Predictably, Richard and David go uncomfortably numb at this discussion. “Look, Syd,” says David. “We’re riding the gravy train here. We just want to start saving some money. Which definition is easiest?” Syd wants to make sure that Richard and David don’t end up like two lost souls swimming in a fishbowl. He will need to review what their employees are paid to determine what definition of compensation will best fit their needs.

Within a plan, compensation is used for at least four different purposes, and the definitions of compensation can be different for each purpose. The definition for statutory purposes (such as determining who is a highly compensated employee or calculating the limits on contributions and benefits) is the Internal Revenue Code (the “Code”) Section 415 definition, which may be one of four options: currently includible compensation, or one of the three safe harbor definitions of Form W-2 wages, Code Section 3401(a) compensation, or simplified Code Section 415 compensation. The plan will also define compensation for allocation purposes (which must be a nondiscriminatory definition if one of the safe harbor allocation formulas is used), testing compensation (which also must be a nondiscriminatory definition), and, for 401(k), 403(b), and 457 plans, the definition of deferrable compensation (which can be any reasonable definition and need not be nondiscriminatory). The statutory definition, allocation compensation (assuming allocations are based on compensation), and deferrable compensation all need to be defined in the plan, whereas the testing compensation is often chosen by the TPA as part of the testing process and need not be in the document.

Preapproved plan documents will include sections where the various definitions are outlined, often providing the Code Section 415 and its safe harbors as checkboxes, prompting plan sponsors in that direction. These definitions overlap in many ways. For the many employees that earn hourly wages, overtime, salary, commissions, and bonuses, all of those items will be included in compensation, no matter which definition is selected. In certain circumstances, however, the choice of definition will significantly alter what compensation is included for plan purposes. Advisors should talk with their clients about compensation during the initial plan design process, and the issue should be touched on periodically thereafter with the plan sponsor, in case their typical employee population or compensation practices shift.

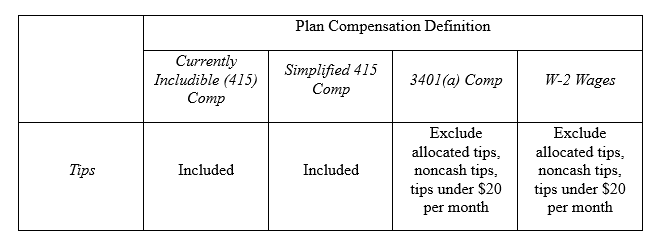

For a chart reflecting some of the key similarities and differences between the various definitions of compensation, have a look at this comparison from Fidelity.

Tips

This will be the most common compensation to consider in certain industries. The Golden Circle is a restaurant with 20 employees located in Georgia. Patrons typically dine in, and tipping is customary. As such, The Golden Circle is required to allocate tips to its employees, if applicable. Employees of The Golden Circle must report tips they receive to their employer. If The Golden Circle adopts a retirement plan that uses currently includible compensation or simplified 415 compensation, all tips are included for compensation purposes. If it instead selects 3401(a) compensation or W-2 wages, allocated tips, noncash tips, and tips under $20 per month will be excluded from plan compensation.

What are allocated tips?

Certain large employers (in this case, large means regularly employing 10 or more employees) are required to report allocated tips. If the total tips reported by all employees are less than 8 percent of the gross receipts on food and beverage sales, the employer must calculate that difference and allocate the difference among the tipped employees. Allocated tips are reported in Box 8 on Form W-2. They are not subject to withholding for income, Social Security, or Medicare taxes.

The chart below shows that the definition of compensation significantly impacts the compensation earned by tipped employees for plan purposes.

Caveat: At time of writing, pending legislation would alter treatment of tips, making them exempt from income taxation. If passed, this would remove tips from compensation for many employees. (The same fate would apply to overtime.)

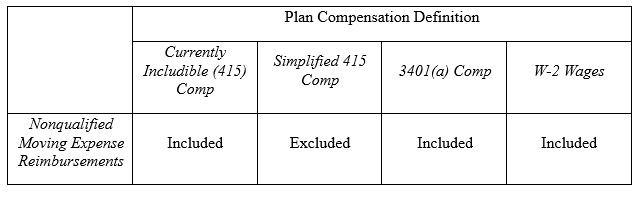

Nonqualified Moving Expense Reimbursements

Hello? Is there anybody in there? Prism Manufacturing is located in a remote area of a state with little population. As a result, they have staffing challenges. Prism has dealt with this by raising salaries considerably and covering moving expenses for its new employees. The IRS has historically differentiated between qualified and nonqualified moving expense reimbursements. Nonqualified moving expense reimbursements are not deductible for the individual and are included in income under all definitions except simplified 415 compensation. For nonqualified moving expense reimbursements, then, if the plan uses the simplified 415 compensation definition, the employee will be taxed on this amount as income, yet it will excluded for plan purposes. If Prism intends its reimbursements to be an incentive for new hires and does not think of it as ordinary compensation, it may want to use simplified 415 compensation to exclude these amounts for plan purposes.

What are qualified moving expense reimbursements?

Qualified moving expense reimbursements are those that an employee could deduct on their tax returns if they had paid or incurred them without reimbursement. Qualified moving expense reimbursements must meet both a distance test and a time test. The distance test is met if the new job location is at least 50 miles farther from the employee’s old home than the old job location was. The time test is met if the employee works at least 39 weeks during the first 12 months after arriving at the new job location.

As an aside, qualified moving expenses are normally excluded from all definitions of compensation; or rather, they may be excluded again soon. For tax years between 2018 and 2025, however, qualified moving expenses were and are included in the definition of compensation when using currently includible compensation and W-2 wages due to the Tax Cuts and Jobs Act. For these years, these expenses are no longer deductible by the individual taxpayers, except for certain members of the U.S. Armed Forces.

Caveat: At time of writing, there is pending legislation that will permanently do away with the deduction for qualified moving expenses. If passed, all moving expense reimbursements will be included in income under all definitions except simplified 415 compensation.

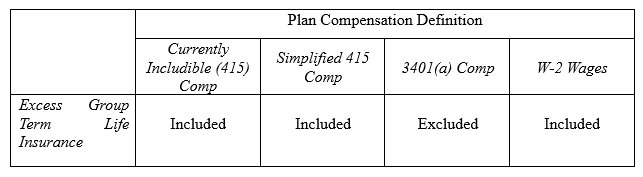

Excess Group Term Life Insurance

Division Bell provides life insurance to some of its executives. The executives naturally consider this a perk and do not expect it to be included in income or in the definition of compensation on which plan contributions and benefits are based. As such, Division Bell may want to use 3401(a) compensation, which is the only definition that excludes excess group term life insurance from compensation for plan purposes.

What is excess group term life insurance?

Excess group term life insurance occurs where coverage for an employee exceeds $50,000 and the policy is considered carried, directly or indirectly, by the employer. When coverage exceeds $50,000, the imputed cost of coverage that exceeds $50,000 must be included in the affected employee’s income. These amounts are subject to Social Security and Medicare taxes.

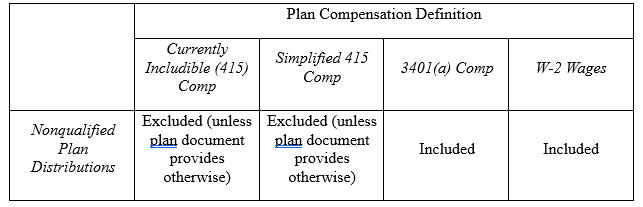

Distributions From a Nonqualified Deferred Compensation Plan

The Machine, LLC sponsors a 401(k) plan with a safe harbor match for all 300 employees. It also sponsors a nonqualified deferred compensation plan (“NQDC”) covering five of its high level executives. When distributions from an NQDC are made, those amounts are reported as income on Form W-2 for the year in which the distribution is received. This is true even if the individual participant receiving the compensation is no longer an active employee.

The Machine does not want to include distributions from the NQDC in compensation when calculating the safe harbor matching contribution. It may choose to use one of the 415 definitions of compensation, as they both default to excluding these amounts from compensation.

(If you’re thinking to yourself: “Anyone receiving NQDC distributions probably will also be a highly compensation employee. Why not just exclude HCEs from receiving the safe harbor match?” Yeah, yeah, that’s also an option.)

Nonstatutory Stock Options

Great Gigs, Inc. wants to provide nonstatutory stock options to some of its more senior employees in hopes it will encourage them to stick around and be financially invested in growing the company. Great Gigs sensibly reaches out to its TPA, Syd, to ask if this will affect anything in its existing retirement plan.

For nonstatutory stock options, the key will be when the income is included in compensation for these employees. This is dependent on whether the fair market value (“FMV”) of the stock option can be readily determined. Typically, only options that are actively traded on an established market have FMV that can be readily determined. They will be taxable when granted. For those options for which FMV cannot be readily determined, the options are taxable when exercised by the employee.

What are statutory and nonstatutory stock options?

Statutory stock options are those that are granted under an employee stock purchase plan (per Code Section 423) or incentive stock option plan (per Code Section 422). Nonstatutory stock options are those that are not granted under those types of plans, or that exceed certain limits within the plans.

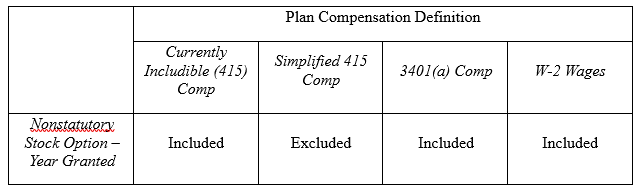

Nonstatutory stock options that are includible in income in the year granted.

If Great Gigs is actively traded on an established market, the nonstatutory stock options it grants to its employees are included in income in the year granted. If Great Gigs wants to exclude these amounts from compensation for plan purposes, it should use the simplified 415 definition.

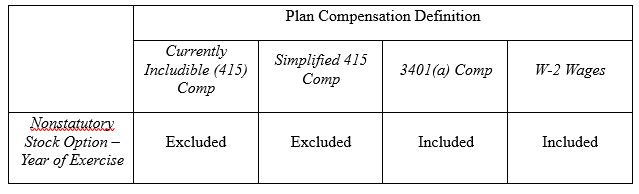

Nonstatutory stock options that are includible in income in the year of exercise.

As is more likely the case, if Great Gigs is not actively traded on an established market, the FMV is not readily determinable. Therefore, the stock options are not included in income until exercised. If Great Gigs wants to exclude these amounts from compensation for plan purposes, it should use either definition of 415 compensation.

The Final Cut: Finishing Shine On, Inc.’s Plan Design

Armed with this knowledge, Richard and David have the answer to their question about the proper definition for Shine On, Inc. Although the company has tipped employees and the owners are open to creating an NQDC plan for key executives sometime in the future, they decide Form W-2 wages will be the easiest for them to administer. Syd prepares a plan document reflecting this and sends Richard and Dave a reminder of how to correctly pull compensation from the Forms W-2 each year when he sends the annual information request.

Let us help you solve your own compensation dilemmas! If you have compensation consternation, call us. After all, we are your ERISA solution!

Additional Resources

Tips: https://www.irs.gov/businesses/small-businesses-self-employed/tip-recordkeeping-and-reporting

Tips: https://www.irs.gov/pub/irs-pdf/p531.pdf

Group term life insurance: https://www.irs.gov/government-entities/federal-state-local-governments/group-term-life-insurance

Stock options: https://www.irs.gov/taxtopics/tc427

Pending legislation: https://www.congress.gov/bill/119th-congress/house-bill/1

- Posted by Ferenczy Benefits Law Center

- On June 17, 2025