Solutions in a Flash – Retirement Plan Correction Solution: “When the Bubble Bursts” – Identifying Partial Plan Terminations and Taking Appropriate Action

Retirement Plan Correction Solution

“When the Bubble Bursts” – Identifying Partial Plan Terminations and Taking Appropriate Action

Sara A. Liva, Esq.

Fancy Fins, Inc. (“FFI”) is an aquaculture company that supplies captive bred saltwater fish for the ornamental aquarium trade. FFI sponsors the Fancy Fins 401(k) Plan (the “Plan”), which covers the employees in all its facilities. In mid-June of 2023, Mr. Swims called the Plan’s TPA, Ms. Ventura, discuss preparation of the Form 5500-SF for 2022. While bemoaning the company’s bad fortune over the past two years, Mr. Swims talked about the downsizing of one and the closure of another facility. Ms. Ventura interrupted Mr. Swims’ rambling to ask for additional details about the company’s layoffs and to express concern about the possibility that the Plan has experienced a partial termination under Internal Revenue Code (“IRC”) §411(d)(3). Flustered, Mr. Swims asked what that could mean for the Plan. Ms. Ventura reassured Mr. Swims that she would perform an analysis to determine if a partial termination has occurred, and if it has, advise FFI what it needs to do now.

How Partial Terminations Occur

The Most Common Cause: High Unusual Turnover

In general, IRC §411(d)(3) provides that, when a significant percentage of employees participating in a qualified plan are terminated or otherwise no longer eligible to participate in the plan, a “partial termination” occurs. The Code does not define when exactly a partial termination occurs. Treas. Reg. §1.411(d)-3 states only that partial terminations are judged based on the facts and circumstances. When a partial termination occurs, the terminated participants are to be 100% vested, as if the plan were terminated in relation to them.

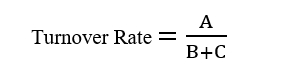

The IRS issued more guidance about partial terminations in Rev. Rul. 2007-43 (the “Rev. Rul.”). The Rev. Rul. provides that an employee turnover rate of 20% or greater creates a rebuttable presumption that a partial termination occurred. “Turnover rate” is defined as follows:

A = Number of participating employees who had an employer-initiated severance from employment during the applicable period

B = Total number of participating employees in the Plan at the start of the applicable period

C = Number of employees who became participants during the applicable period

What is the “applicable period?” The IRS says that the applicable period depends on the circumstances. More often than not, the applicable period is the plan year in which the terminations occurred. However, the period could be longer if there are a series of related severances from employment (for example, if lay-offs related to a downsizing occur over two plan years to boost the bottom line prior to sale).

An “employer-initiated severance from employment” is a surprisingly expansive term, including all terminations of employment for any reason other than death, disability, or retirement. The IRS guidance clearly indicates that terminations of employment other than for death, disability, or retirement are presumed to be “employer-initiated” unless the employer can somehow support that the severance was purely voluntary through its personnel files or other proof.

The IRS guidance notes, however, that routine turnover, where people leave and people are hired to replace them, is less likely to be considered a partial termination. In addition, the IRS looks closely at facts and circumstances in relation to very small employers for whom one employee quitting may constitute a more than 20% decrease in staff (and for whom blind application of the 20% definition would be tantamount to requiring 100% vesting for all employees).

Applying the Rules to Fancy Fins, Inc.

FFI experienced two events that could, either separately or together, result in a partial termination. As noted above, multiple related severances may cause the plan administrator to judge the partial termination over multiple plan years. However, in this case, the layoffs were arguably independent of each other. Unfortunately, there is no clear IRS guidance for determining when multiple events should be considered “a series of related severances.”

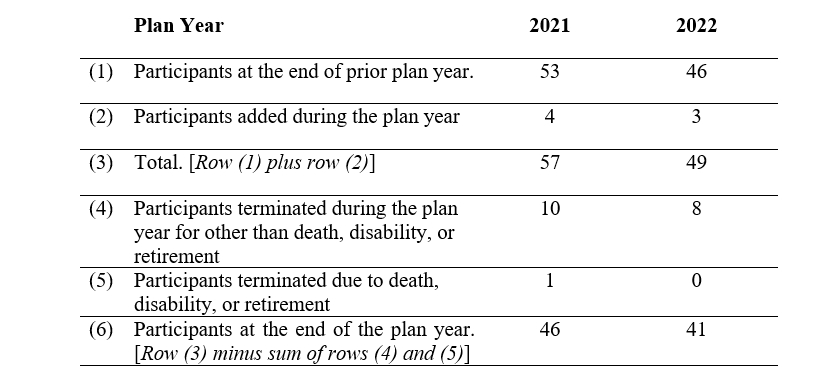

To be on the safe side, Ms. Ventura decides to examine the effect of considering the layoffs to be related so that the partial termination is judged over both years. 401(k) Plan is a calendar year plan, Ms. Ventura considers the “applicable period” to run from January 1, 2021 (the beginning of the year in which the Peppermint Angelfish staff was laid off), to December 31, 2022 (the end of the year in which the Potters Angelfish facility closed). She compiles the following data with respect to all participants of the Plan (including all of the participating companies and facilities, and not just those who were affected by the identified events):

Note that the terminations considered on lines #4 and #5 above include all terminations, not just those at the two affected facilities.

The turnover rate for the period beginning January 1, 2020, and ending on December 31, 2022, is equal to the number of participating employees who had an employer-initiated severance from employment during the applicable period (18), divided by the sum of all of the participating employees at the start of the applicable period (53), plus the employees who became participants during the applicable period (7): [(18/60)], or 30%. Thus, if the IRS considers the layoffs that occurred in 2021 and 2022 to be a “series of related severances” the turnover rate for that two-year period would create a presumption that a partial termination has occurred.

Note that the turnover rate for the year 2021 alone is equal to 10/57, or 17.5%. And, for the year 2022 alone, the turnover rate is equal to 8/49, or 16.3%. In other words, if we consider what happened at each facility to be two separate events, neither event caused sufficient turnover to create a presumptive partial termination.

Which is correct? Again, it’s a facts and circumstances test.

It is worth noting that this example covers years during which the COVID pandemic occurred. Responding to the mass layoffs, and high turnover rates caused by the COVID-19 pandemic, Congress passed the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (the “Act”). Under the Act, no partial termination is deemed to occur during the plan years including the period beginning on March 13, 2020, and ending on March 31, 2021, if the number of active participants covered by the plan on March 31, 2021, is at least 80% of the number of active participants covered by the plan on March 13, 2020. While the purpose of this exception was to help employers forced to lay off employees because of the pandemic, the rule applies to any plan that experienced a decline in active participants during the period, regardless of the actual reasons for the layoffs.

If we had found that there was a partial termination in 2021 (the one of the two affected years covered by the COVID exception), we could have used this as a possible way to avoid a partial termination. It is not clear how the exception applies if you have a possible multi-year partial termination, and only one of the years is within the ambit of the exception.

Other Potential Causes of Partial Terminations

While downsizing and location/plant closures are the most common causes of partial termination, a partial termination can also result from a plan amendment that causes a significant number or percentage of employees to lose eligibility to participate in the plan. Defined benefit plans may also experience a partial plan termination if they are amended in such a manner as to increase the potential for a reversion to the employer if an actual termination were to occur.

What Happens If There Is A Partial Termination

As noted above, if there is a partial termination, the affected employees must be fully vested. Unlike a normal plan termination, however, there is no obligation to distribute benefits on a partial termination. If employees are eligible for a distribution of their benefit from the plan because of their termination of employment, they may request their funds. However, if the plan delays distributions for a period after someone leaves the company, a partial termination does not require an acceleration of those payments.

Which Employees are Affected?

The Rev. Rul. cited above provides that any participant experiencing a severance of employment during the partial termination period must be fully vested (even if they are not part of any event thought to give rise to the partial termination). Participants who did not terminate during the relevant period are unaffected.

So, How Does The Fancy Fins Situation Shake Out?

Ms. Ventura carefully considers the situation of FFI. On the one hand, if the two years are considered together, there is a partial termination. If the years are considered separately, there is not. Because the two events causing the turnover are completely separate, Ms. Ventura believes there is no partial termination.

Nonetheless, as this is not a “cut and dried” situation, Ms. Ventura discusses the issue completely with Mr. Swims. She explains that, if FFI decides to treat the situation as a partial termination, they must consider the account of any employee who terminated employment during the 2020-2022 period be treated as fully vested as of their last day of employment. “That might be a problem,” Mr. Swims tells Ms. Ventura. “We already allocated the forfeited nonvested benefits to the accounts of the other participants.” Ms. Ventura informs Mr. Swims that there are ways under the IRS’s correction programs to fix that problem if FFI decides that a partial termination has occurred. (Section 2.03 of EPCRS, Revenue Procedure 2021-30, discusses how to correct vesting mistakes.)

Remember that finding a partial termination is only an issue of vesting. Therefore, it is commonly not expensive to conservatively find that a partial termination has occurred when the result of the analysis is not obvious. In the FFI situation, where there are two possible outcomes, deciding which route to take may be one of assessing the cost of the full vesting.

Ms. Ventura also tells Mr. Swims that FFI could request an IRS determination as to whether a partial termination has occurred by filing IRS Form 5300. A user fee for this determination is $300 for plans with fewer than 100 participants and $2,700 for larger plans. It may take several months to get a response to this request. Again, the cost of the filing, coupled with the time delay while waiting for the ruling, may convince Mr. Swims to go forward with Ms. Ventura’s recommendation.

Conclusion

Partial terminations are not rare and, according to the IRS website, they are commonly misidentified or treated incorrectly by plan sponsors. FFI is lucky that their TPA astutely assessed its situation and gave them cogent advice about their choices.

If you have questions about partial terminations or anything regarding your employee benefit plans, please let us know. After all, we at FBLC are your ERISA solution!

- Posted by Ferenczy Benefits Law Center

- On June 13, 2023