FlashPoint – Grabbing Victory Out of the Jaws of Defeat Late Plan Restatements

Understanding that there may be some situations in which the looming April 30 restatement deadline cannot be met by some adopters of defined contribution pre-approved plan documents, the IRS got the jump on providing practitioners with assistance for resolving these nonamender problems.

Nonamenders: Big Trouble!

A failure to restate the plan on a timely basis results in the plan’s loss of its qualified status (called “disqualification”). This could mean that:

- The sponsoring company may lose some or all if its tax deductions for plan contributions;

- Participants in the plan may be taxed on some or all of their contributions;

- The trust loses its tax-exempt status and the earnings of the trust are subject to taxation; and

- Any distributions from the plan during the time it is disqualified are immediately taxable and not eligible for rollover.

Needless to say, disqualification is hugely expensive for both the plan sponsor and its participants.

IRS Action to Help Resolve the Problems

The IRS has addressed two types of nonamender situations: those affecting individual plans and their sponsors and those that affect m any clients of given service providers.

Important note: Both of these programs require that the affected plan has been updated for the prior restatement cycle, i.e., for EGTRRA, and that the late document only relates to the changes that were due by April 30, 2016. If your plan was not updated on the earlier cycle, there are still ways to resolve that, but these program s do not apply.

Situation #1: Isolated Failure to Timely Amend by a Given Plan Sponsor

If an individual company fails to sign its restated document by the end of April, the company may preserve the plan’s qualified status by filing the problem under the IRS’s Voluntary Compliance Program (VCP). The IRS provides stream lined instructions for this type of filing on its website, here: https://www .irs.gov/Retirement- Plans/V C P-Submission-Kit-Failure-to-adopt-a-new-Pre-Approved-Defined-Contribution-Plan-by-the-April-30-2016-Deadline

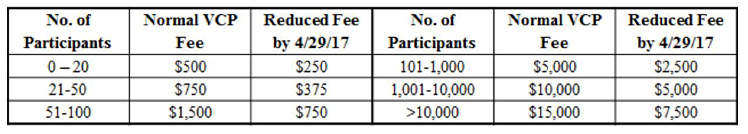

There is a user fee that must be paid to the IRS along with this filing. The fee is reduced by 50% if the corrective filing is made by not later than April 29, 2017:

Note that you will need to include Form 8951, which is supposed to go with your fee payment, with your filing. This form has not been updated for the IRS’s previous reduction in the normal VCP fees. Therefore, you should refer to the above table, rather than the form, for the applicable fee amount.

Situation #2: Umbrella Closing Agreement for Practitioners With at Least 20 Affected Plans

If you are a service provider that sponsors a preapproved plan document and you have at least 20 clients who are nonamenders, you may file to protect those plans on an omnibus basis under another program the IRS has established. The IRS describes this Umbrella Program on its website, here: https://www.irs.gov/Retirement- Plans/New-Program-Allows-Providers-of-Pre-Approved-Plan-to-Correct-Missed-Deadlines

Under this program, the service provider may file for all its clients’ affected plans if it:

- Obtains affirmative agreement by the plan’s adopting employer to participate in the program;

- Certifies that the affected plan sponsors previously timely adopted the plans’ EGTRRA restatements in relation to the amendment cycle before the current cycle (or previously had that failure resolved under the IRS VCP program);

- Certifies that the affected plan sponsors have now adopted the PPA restatement;

- Provides the IRS with a letter outlining its proposal for resolution of the affected plans;

- Pays a user fee; and

- By the later of May 1, 2017, or 120 days after the IRS executes the closing agreement, provides a final list of affected employers and pays any additional fees.

The program does not require that the failure to adopt a timely restatement be the service provider’s fault or the result of a systemic error by the service provider. Therefore, this program may be used by a service provider who has 20 or more plans that were not signed timely by their plan sponsors for whatever reason.

If some of the 20 restatement failures are due to clients who are nonresponsive, it is possible that they will continue to fail to respond to a practitioner’s solicitation for this program. As there must be 20 plans to take advantage of this program, a practitioner whose initial solicitations to nonresponsive clients produce fewer than 20 plans may be caught in a conundrum – should we file the regular VCPs for the clients who responded or should we wait to see if we can get to the 20 client minimum for the Umbrella filing. It may be the better part of valor to go forward to protect the more responsive clients through VCP than to dawdle while awaiting the slowpokes to finally take action.

The fees under this Umbrella Program are:

- $5,000 for the first 20 plans; plus

- $250 for each additional plan, up to a maximum of

- $50,000 total.

The IRS’s communication of the program indicates that the $5,000 minimum will go up to $10,000 after April 29, 2017.

- Posted by Ilene Ferenczy

- On April 27, 2016